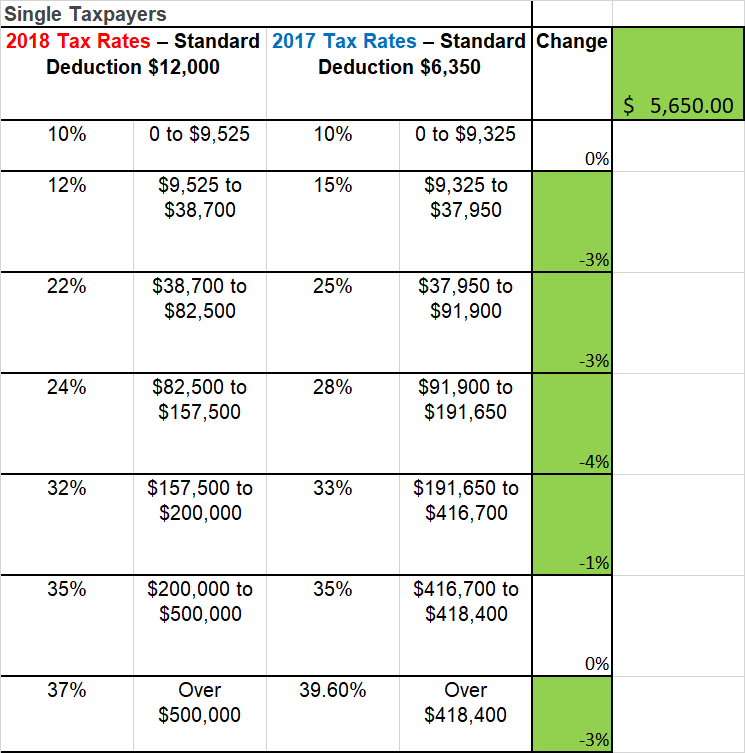

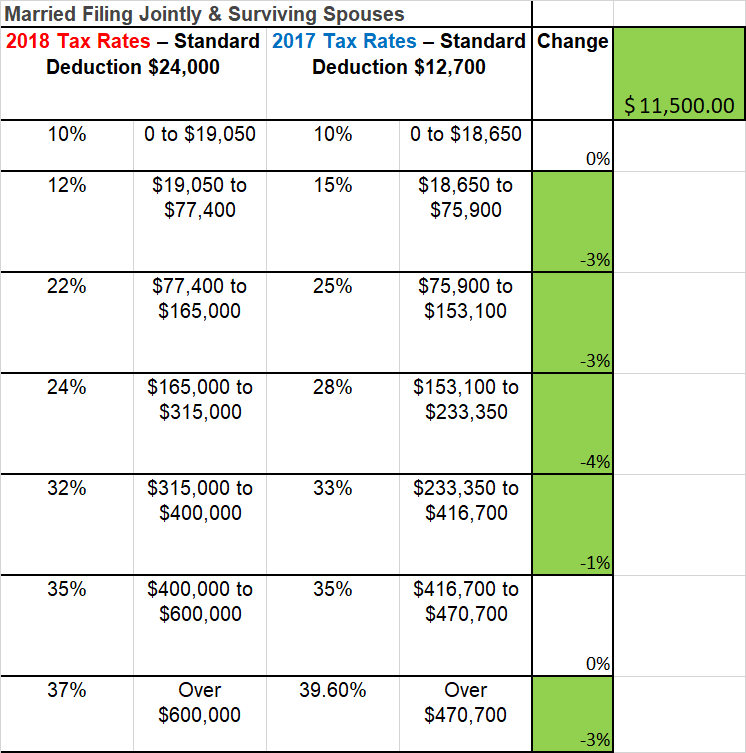

2018 VS. 2017 federal TAX BRACKETSThe Standard Tax Deductions for 2017 are changing for 2018.

These should benefit many of you filing your 2018 Tax Returns by April 15, 2019. * See the charts below showing the comparison of change from 2017 to 2018. Most Tax Brackets and Tax Percentages improve for most Net Incomes. There are a couple of Tax Brackets that remain flat at 0% with no change. And Some Tax Brackets have been widened to a larger band of Net Income. Single Taxpayers – Standard Deduction improves by $5,650 to a 2018 Deduction of $12,000! - or - Married Filing Jointly / Surviving Spouses Taxpayers – Standard Deduction improves by $11,500 to a 2018 Deduction of $24,000! |

QUICK CONTACTFINANCIAL VIDEOS |

Call Western States Investments should you have questions regarding the impact to your Federal Taxes due to the changes of the 2018 Standard Deductions and Tax Brackets.

Call (951)371-7608 today!

Call (951)371-7608 today!