What are the different types of IRAs? How do they work? What can they do for you?

What is an i.r.a.?

An I.R.A. is an "Individual Retirement Account."

An Individual Retirement Account (I.R.A.) is an investing tool that Individuals use to earn and earmark funds for Retirement Savings and Income. Individual IRAs can be set-up, one for each spouse, for your future as a Nest Egg, so that you will be comfortable in your Retirement years.

An Individual Retirement Account (I.R.A.) is an investing tool that Individuals use to earn and earmark funds for Retirement Savings and Income. Individual IRAs can be set-up, one for each spouse, for your future as a Nest Egg, so that you will be comfortable in your Retirement years.

Types of I.R.A.s

There are several types of IRAs:

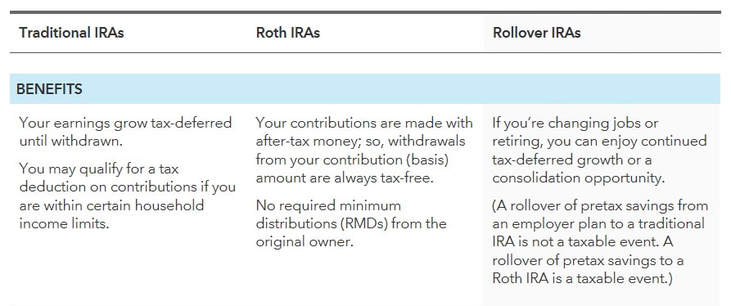

- Traditional IRAs

- Roth IRAs

- SIMPLE IRAs

- SEP IRAs

difference in I.R.A.S

- Individual Taxpayers will establish Traditional and Roth IRAs.

- Small Business Owners and Self-Employed Individuals will establish SEP and SIMPLE IRAs.

i.r.a. rollovers

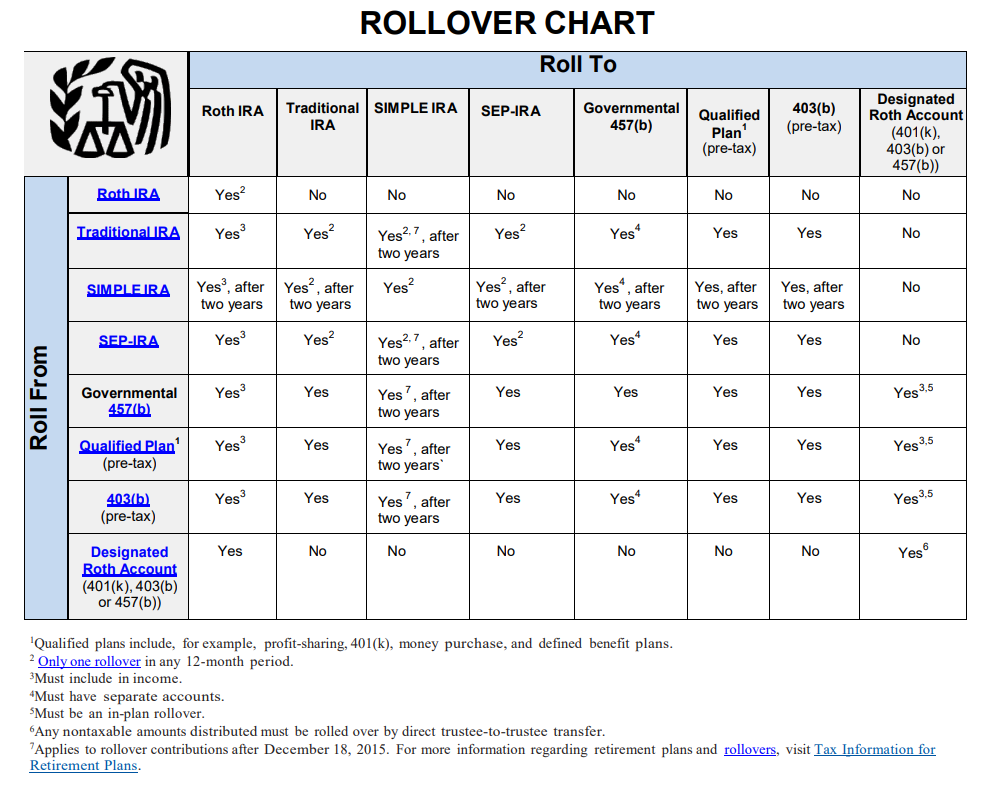

Most pre-retirement payments you receive from a Retirement Plan or IRA can be “rolled over” by depositing the payment in another Retirement Plan or IRA within 60 days. You can also have your Financial Institution (Bank) or Plan directly transfer the payment to another Plan or IRA. Rollover Chart (irs.gov)

Call Western States Investments for more about IRAs and the best options for you.

Or call regarding needing an IRA Rollover and WSI will be glad to help.

Call (951) 371-7608 today!

Or call regarding needing an IRA Rollover and WSI will be glad to help.

Call (951) 371-7608 today!