Indexed Universal Life Insurance

What is an IUL all about?

What could an IUL do for you?

How might an IUL benefit you?

What could an IUL do for you?

How might an IUL benefit you?

Indexed Universal Life (IUL) insurance allows the owner to allocate cash value amounts to either a fixed account or an equity index account. P olicies offer a variety of well-known indexes, such as the Nasdaq 100 or S&P 500.

IUL Insurance policies are more volatile than Fixed Universal Life (UL) Insurance policies, yet they are less risky than Variable UL Insurance policies, because no money is actually invested in equity positions.

IUL Insurance policies are more volatile than Fixed Universal Life (UL) Insurance policies, yet they are less risky than Variable UL Insurance policies, because no money is actually invested in equity positions.

what could aN IUL do for you?• Allows you to create your own self-completing retirement plan

• Provides you with supplemental retirement income for corporate executives to every day employees • Aid you in avoiding the threat of higher income taxes in the future...”The Real Fiscal Cliff” • Addresses Estate Tax issues at death and paying off any debt • Guarantees that what you want to happen financially in your life will happen, whether or not you are here to see it happen • Affords you to become your own bank and making more efficient purchasing decisions • Provides you with access to funds that may be earmarked for retirement purposes if needed • Open up multiple investments uses on the same investment dollar • Paying for your or your child's / children's college education without being disqualified from financial aid • Enable you to address your long term care needs later in life • Creates a Tax-Free Income stream at retirement or when you desire to start taking it |

Benefits of an iul policy?They offer the greatest benefit for investors who have already maximized other Tax-Advantaged Retirement Savings plans.

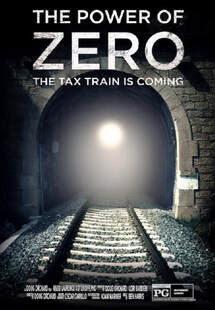

Retirement cash needs are satisfied from your IUL Policy via loans and withdrawals for any needed reason. You borrow from yourself to yourself, and then pay yourself back to the loan in the policy. Because it is Life Insurance, it is taxed on a first in, first out (FIFO) basis, tax-free withdrawals can be made up to basis. In death, an IUL Policy provides income protection in the event that you can no longer provide that retirement income for those you love. In the event of your death, an IUL provides your Beneficiaries a Tax-Free Death benefit. LIRPs (Life Insurance Retirement Plans) are promoted in the movie “The Power of Zero ” "The Tax Train Is Coming". “How to Get to the 0% Tax Bracket and Transform Your Retirement.” |

Call Western States Financial to see if an IUL and having Tax-Free Retirement Income is right for you.

Call (951)371-7608 today!

Call (951)371-7608 today!