individual retirment accounts

We are here to help Individuals with their Financial Life Planning from the very beginning in saving for Retirement, then throughout their entire life and in planning for leaving a Legacy to your Heirs.

We offer help with:

We offer help with:

We exist to create a life of freedom so you can pursue your dreams

and live your God-Given purpose.

and live your God-Given purpose.

WHAT ABOUT ROLLING OVER YOUR 401(k)?

What is all involved in rolling over your 401(k) once you leave an Employer / Copmpany?

A 401(k) Rollover is when you leave an Employer where you have been investing in the Company Sponsored Retirement Plan, you have several options as to what you can to do with the account. Many people are uncomfortable leaving their Retirement Account with a previous Employer, especially if they continually changing jobs. Leaving all your 401k Retirement Plans scattered among old employers puts you at risk of missing your retirement goals for lack of organization and corporate malfeasance. A 401k rollover is simply the process of moving your previous Employer Retirement Plan account to an Individual Retirement Account (IRA) or one of the other 3 options available.

A 403(b) Tax-Sheltered Annuity (TSA) Plan is a retirement plan offered by public schools, certain tax-exempt organizations, hospitals, home health service agencies, health and welfare agencies, churches, or convention or associations of churches. An individual’s 403(b) Annuity can be obtained only under an employer’s TSA plan. Generally, these Annuities are funded by elective deferrals made under salary reduction agreements and non-elective employer contributions. A number of tax-free transfers and rollovers of 403(b) plans are permissible under the tax laws.

A 457(b) Deferred Compensation Plan is a retirement plan offered by Government Employer. Once you leave your Employer / Company, you are now eligible to rollover distributions tax free to a traditional IRA, as well as to a 401(k), 403(b), or 457 governmental plan that accepts rollovers. The portability provisions allow you to consolidate your Retirement Accounts.

A 457(b) Deferred Compensation Plan is a retirement plan offered by Government Employer. Once you leave your Employer / Company, you are now eligible to rollover distributions tax free to a traditional IRA, as well as to a 401(k), 403(b), or 457 governmental plan that accepts rollovers. The portability provisions allow you to consolidate your Retirement Accounts.

LET'S TALK ABOUT IRAs

WHAT IS AN I.R.A.?

An I.R.A. is an "Individual Retirement Account."

An Individual Retirement Account (I.R.A.) is an investing tool that Individuals use to earn and earmark funds for Retirement Savings and Income. Individual IRAs can be set-up, one for each spouse, for your future as a Nest Egg, so that you will be comfortable in your Retirement years.

An Individual Retirement Account (I.R.A.) is an investing tool that Individuals use to earn and earmark funds for Retirement Savings and Income. Individual IRAs can be set-up, one for each spouse, for your future as a Nest Egg, so that you will be comfortable in your Retirement years.

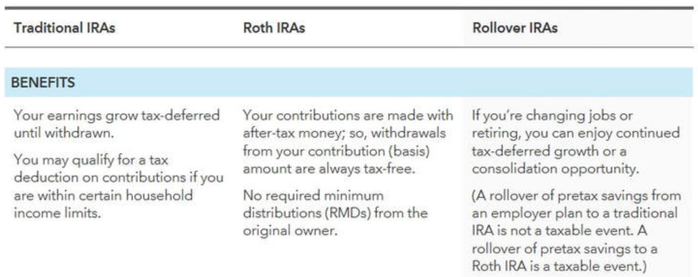

What are the different types of IRAs? How do they work? What can they do for you?

TYPES OF I.R.A.s

There are several types of Personal IRAs:

Stocks, Bonds and/or Mutual Funds.

- Traditional IRAs - PRE-TAX (Tax Deferred) IRAs

- Roth IRAs - After-Taxes Paid IRAs

Stocks, Bonds and/or Mutual Funds.

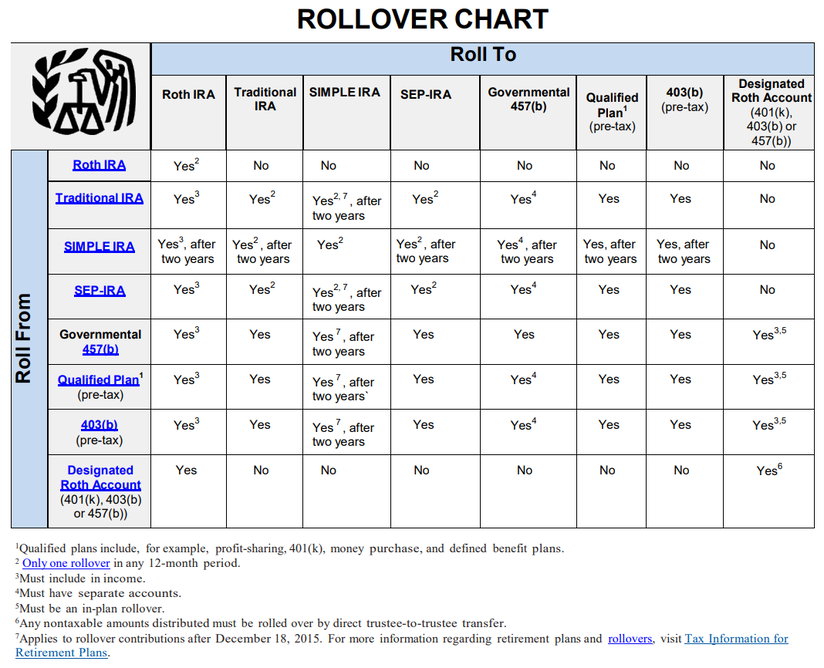

I.R.A. ROLLOVERS

Most pre-retirement payments you receive from a Retirement Plan or IRA can be “rolled over” by depositing the payment in another Retirement Plan or IRA within 60 days. You can also have your Financial Institution (Bank) or Plan directly transfer the payment to another Plan or IRA. Rollover Chart (irs.gov)

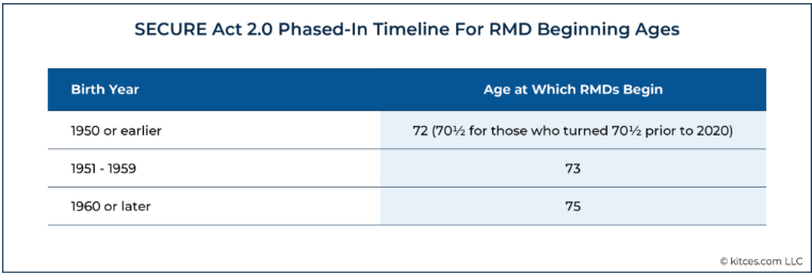

REQUIRED MINIMUM DISTRIBUTIONS CHANGES FOR 2023.

Call John @ (951) 371- 7608

to schedule your free Individual Retirement Accounts consultation discussion.

to schedule your free Individual Retirement Accounts consultation discussion.