What are 401(k)s? How do they work? What can they do for you?

An Employer Matching Program is an Employer’s potential payment to an Employee’s 401(k) plan dependent on the extent of an Employee’s employment with the Company & participation in the Retirement Plan.

A 401(k) Plan is a defined contribution plan where an Employee can make contributions from his or her paycheck either before or after-tax, depending on the options offered in the plan. The contributions go into a 401(k) account, with the Employee often choosing the Investments based on options provided under the plan. Under some plans, the Employer also makes contributions such as matching the Employee’s contributions up to a certain percentage. SIMPLE and safe harbor 401(k) plans have mandatory Employer contributions.

In the United States, a 401(k) plan is the tax-qualified, defined-contribution pension account defined in subsection 401(k) of the Internal Revenue Code. Under the plan, retirement savings contributions are provided (and sometimes proportionately matched) by an Employer, deducted from the Employee's paycheck before taxation (therefore tax-deferred until withdrawn after retirement or as otherwise permitted by applicable law), and limited to a maximum pre-tax annual contribution of $18,500 or if 50 yrs. old+ then $24,500 can be contributed in 2018.

_________________________________________________________________________________________________________________________________

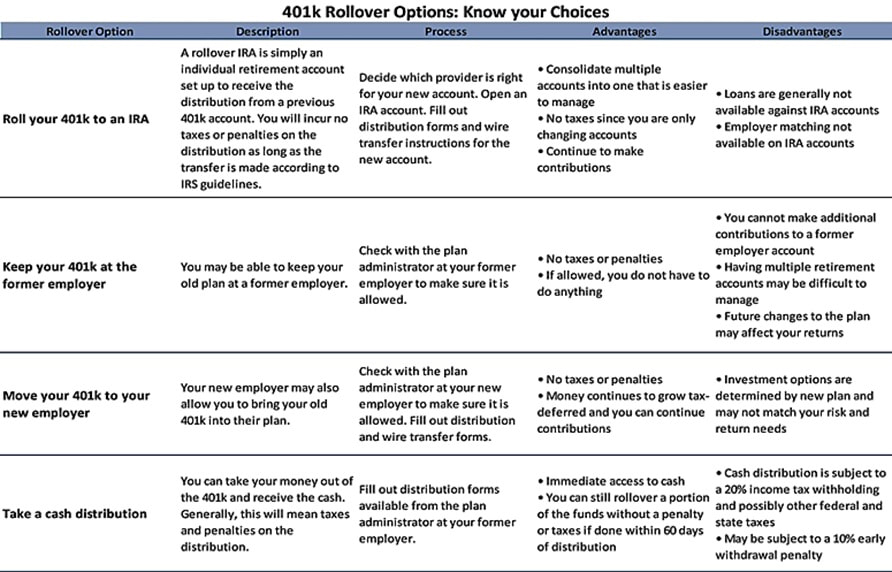

A 401(k) Rollover is when you leave an Employer where you have been investing in the Company Sponsored Retirement Plan, you have several options as to what you can to do with the account. Many people are uncomfortable leaving their Retirement Account with a previous Employer, especially if they continually changing jobs. Leaving all your 401k Retirement Plans scattered among old employers puts you at risk of missing your retirement goals for lack of organization and corporate malfeasance. A 401k rollover is simply the process of moving your previous Employer Retirement Plan account to an Individual Retirement Account (IRA) or one of the other 3 options available.

_________________________________________________________________________________________________________________________________

A 403(b) Tax-Sheltered Annuity (TSA) Plan is a retirement plan offered by public schools, certain tax-exempt organizations, hospitals, home health service agencies, health and welfare agencies, churches, or convention or associations of churches. An individual’s 403(b) Annuity can be obtained only under an employer’s TSA plan. Generally, these Annuities are funded by elective deferrals made under salary reduction agreements and non-elective employer contributions. A number of tax-free transfers and rollovers of 403(b) plans are permissible under the tax laws.

A 457(b) Deferred Compensation Plan is a retirement plan offered by Government Employer. You are now eligible to rollover distributions tax free to a traditional IRA, as well as to a 401(k), 403(b), or 457 governmental plan that accepts rollovers. The portability provisions allow you to consolidate your Retirement Accounts.

In the United States, a 401(k) plan is the tax-qualified, defined-contribution pension account defined in subsection 401(k) of the Internal Revenue Code. Under the plan, retirement savings contributions are provided (and sometimes proportionately matched) by an Employer, deducted from the Employee's paycheck before taxation (therefore tax-deferred until withdrawn after retirement or as otherwise permitted by applicable law), and limited to a maximum pre-tax annual contribution of $18,500 or if 50 yrs. old+ then $24,500 can be contributed in 2018.

_________________________________________________________________________________________________________________________________

A 401(k) Rollover is when you leave an Employer where you have been investing in the Company Sponsored Retirement Plan, you have several options as to what you can to do with the account. Many people are uncomfortable leaving their Retirement Account with a previous Employer, especially if they continually changing jobs. Leaving all your 401k Retirement Plans scattered among old employers puts you at risk of missing your retirement goals for lack of organization and corporate malfeasance. A 401k rollover is simply the process of moving your previous Employer Retirement Plan account to an Individual Retirement Account (IRA) or one of the other 3 options available.

_________________________________________________________________________________________________________________________________

A 403(b) Tax-Sheltered Annuity (TSA) Plan is a retirement plan offered by public schools, certain tax-exempt organizations, hospitals, home health service agencies, health and welfare agencies, churches, or convention or associations of churches. An individual’s 403(b) Annuity can be obtained only under an employer’s TSA plan. Generally, these Annuities are funded by elective deferrals made under salary reduction agreements and non-elective employer contributions. A number of tax-free transfers and rollovers of 403(b) plans are permissible under the tax laws.

A 457(b) Deferred Compensation Plan is a retirement plan offered by Government Employer. You are now eligible to rollover distributions tax free to a traditional IRA, as well as to a 401(k), 403(b), or 457 governmental plan that accepts rollovers. The portability provisions allow you to consolidate your Retirement Accounts.

Call Western States Investments to find out more about your 401(k) options.

Call (951) 371-7608 today!

Call (951) 371-7608 today!