Here you can easily request a

DVD copy to watch

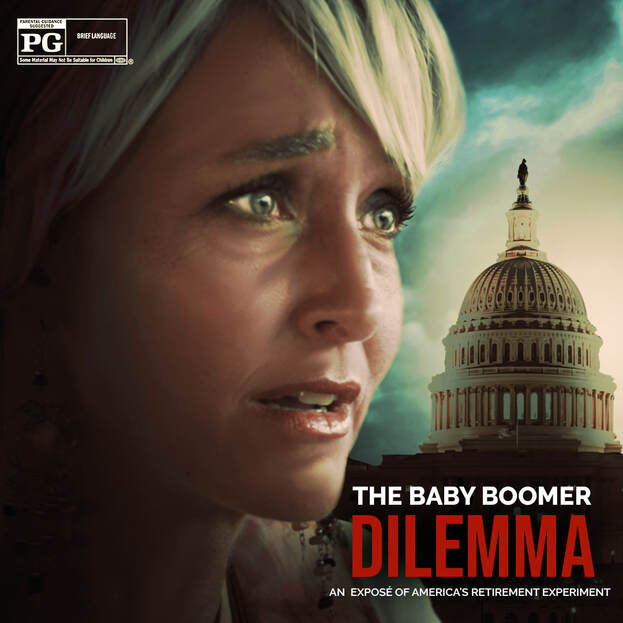

"The Baby Boomer Dilemma"

that was shown on Tuesday April 12, 2022 @ 6:00 PM

and again on August 23, 2022 @ 6:00 PM

at the Starlight DOS LAGOS Luxury THEATRES in Corona CA

It's not just for Baby Boomers! It's also for Millennials, Generation X, Y, & Z too!

So basically, ANYONE & EVERYONE that desires to quit working someday, who wants to maintain their current lifestyle in retirement, and NEVER RUN OUT OF MONEY $$$!

So basically, ANYONE & EVERYONE that desires to quit working someday, who wants to maintain their current lifestyle in retirement, and NEVER RUN OUT OF MONEY $$$!

Trailer for Movie - click here <The Baby Boomer Dilemma - Official Trailer on Vimeo

THIS IS AN EXPOSÉ OF AMERICA'S

RETIREMENT EXPERIMENT

RETIREMENT EXPERIMENT

What is this MOVIE about?This movie is designed open your eyes to:

|

how will it help you?

|

THERE'S SO MANY THINGS TO PREPARE FOR RETIREMENT. THAT DAY WILL COME. PLANNING NOW WILL ENSURE YOU ARE ABLE TO LIVE WHAT YOU DREAMED ABOUT.

We're living longer

- Length of Retirement

- Longevity is increasing

- Inflation will continue

- Taxes will increase

- Possibility of the need for Long-Term Care is now 1 in every 2 persons

- Planning to live to 90 - 100 is prudent

Are you worried about Hyper-Inflation,

Increasing Taxes, Stock Market Volatility,

and the possibly Running out of Money?!

Increasing Taxes, Stock Market Volatility,

and the possibly Running out of Money?!

If you answered YES to any of the above issues,

THEN WHAT'S YOUR PLAN?

to address those IMPENDING RISKS in Retirement???

THEN WHAT'S YOUR PLAN?

to address those IMPENDING RISKS in Retirement???

Should you be worried? If you're not worried, then ask yourself these questions.

Be honest, and don't be just WISHFUL THINKING!

1) How do I know that I will have enough money to last my lifetime?

2) How much will I be paying in Taxes (since Taxes will be going up) during my Retirement?

3) Could I possibly need long-term care? To what age have my parents, family & relatives been living to?

4) Could I possibly have to change my lifestyle in my golden years due to less income?

5) If you only have your 401(k)s & IRAs, is enough invested in there? And how long will it last before running out?

6) How much in Taxes will you have to pay to withdrawl from your 401(k)s or IRAs or your forced Required Minimum Distributions that were at 70 1/2 yrs. old (now @ 72 yrs. old) per the Government?

Be honest, and don't be just WISHFUL THINKING!

1) How do I know that I will have enough money to last my lifetime?

2) How much will I be paying in Taxes (since Taxes will be going up) during my Retirement?

3) Could I possibly need long-term care? To what age have my parents, family & relatives been living to?

4) Could I possibly have to change my lifestyle in my golden years due to less income?

5) If you only have your 401(k)s & IRAs, is enough invested in there? And how long will it last before running out?

6) How much in Taxes will you have to pay to withdrawl from your 401(k)s or IRAs or your forced Required Minimum Distributions that were at 70 1/2 yrs. old (now @ 72 yrs. old) per the Government?

If you CANNOT ANSWER NOR CALCULATE the above questions...

Would you like to know where you are at currently with your Retirement Needs?

Would you like to know where you are at currently with your Retirement Needs?

Then call us @ (951) 371-7608

and we'll schedule an appointment together to discuss your Retirement needs, obtain the needed information, and then with a Consultative Approach, to provide you with options to meet your desired Goals to achieve your Dreams.

and we'll schedule an appointment together to discuss your Retirement needs, obtain the needed information, and then with a Consultative Approach, to provide you with options to meet your desired Goals to achieve your Dreams.

Or schedule an online appointment @

www.WesternStatesFinancial.com/John

and at your conveniently scheduled date & time that you choose, we'll help by providing your with the knowledge and your available options that will enable you to reach your Goals and realize your Dreams. Why would you not want a BETTER RETIREMENT?!

www.WesternStatesFinancial.com/John

and at your conveniently scheduled date & time that you choose, we'll help by providing your with the knowledge and your available options that will enable you to reach your Goals and realize your Dreams. Why would you not want a BETTER RETIREMENT?!

YOU WILL BE GLAD THAT YOU BOOKED YOUR APPOINTMENT!