What is this about?To help you learn all about the most Tax-Efficient and safe manner

to grow and protect your money for a lasting Retirement. |

how will it help you?We will teach you how to potentially avoid paying hundreds of thousands of dollars in Taxes during your Retirement and throughout your lifetime.

|

|

STOCK MARKET RISK

|

LONGEVITY RISK

|

INCOME TAX RISK

|

SO WHAT IS THE CLOSEST THING

TO A PERFECT RETIRMENT VEHICLE?

TO A PERFECT RETIRMENT VEHICLE?

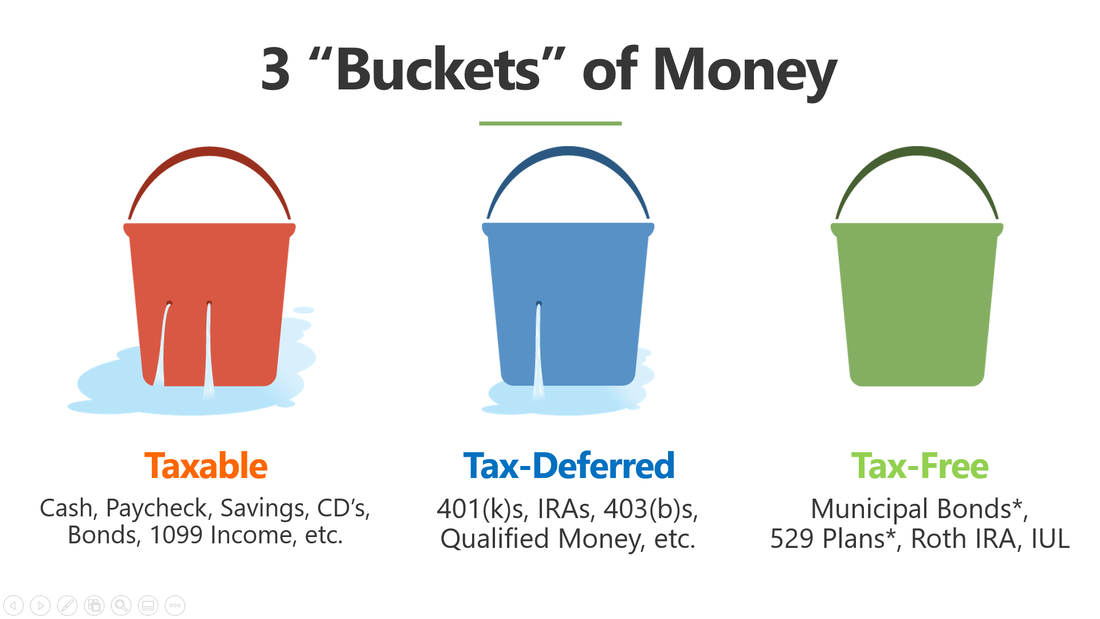

Now think about all your money, assets & investments.

How much money do you have in each bucket below?

How much money do you have in each bucket below?

If you answered the above question and you

DO NOT HAVE ANY MONEY

in the TAX-FREE Bucket for Retirement...

DO NOT HAVE ANY MONEY

in the TAX-FREE Bucket for Retirement...

You should be worried. Yet if you are not worried, then ask yourself these questions.

Be honest, and don't be WISHFUL THINKING!

1) How do I know that I will have enough money to last my lifetime?

2) How much will I be paying in Taxes (since Taxes will be going up) during my Retirement?

3) Could I possibly need long-term care? To what age have my parents, family & relatives been living to?

4) Could I possibly have to change my lifestyle in my golden years due to less income?

5) If you only have your 401(k)s & IRAs, is enough invested in there? And how long will it last before running out?

6) How much in Taxes will you have to pay to withdrawl from your 401(k)s or IRAs or your forced Required Minimum Distributions that were at 70 1/2 yrs. old (now @ 72 yrs. old) per the Government?

Be honest, and don't be WISHFUL THINKING!

1) How do I know that I will have enough money to last my lifetime?

2) How much will I be paying in Taxes (since Taxes will be going up) during my Retirement?

3) Could I possibly need long-term care? To what age have my parents, family & relatives been living to?

4) Could I possibly have to change my lifestyle in my golden years due to less income?

5) If you only have your 401(k)s & IRAs, is enough invested in there? And how long will it last before running out?

6) How much in Taxes will you have to pay to withdrawl from your 401(k)s or IRAs or your forced Required Minimum Distributions that were at 70 1/2 yrs. old (now @ 72 yrs. old) per the Government?

If you CANNOT ANSWER NOR CALCULATE the above questions...

Would you like to know where you are at currently with your Retirement Savings?

Would you like to know where you are at currently with your Retirement Savings?

Then call us @ (951) 371-7608

and we will schedule an appointment to discuss your Retirement needs, obtain the needed information, and then provide you with a Wealth Report for FREE. (A $1,000 Value that can save you tens of thousands of dollars over your Retirement / Lifetime.)

Our Wealth Report will compare all your investments with options for Tax-Free Retiement Income, and will tell you at what AGE YOUR MONEY WILL RUN OUT.

and we will schedule an appointment to discuss your Retirement needs, obtain the needed information, and then provide you with a Wealth Report for FREE. (A $1,000 Value that can save you tens of thousands of dollars over your Retirement / Lifetime.)

Our Wealth Report will compare all your investments with options for Tax-Free Retiement Income, and will tell you at what AGE YOUR MONEY WILL RUN OUT.

Or schedule an online appointment @

www.WesternStatesFinancial.com/John

and at your conveniently scheduled appointment that you choose, we will discuss your Retirement needs, obtain the needed information, and then provide you with a Wealth Report for FREE. (A $1,000 Value that can save you tens of thousands of dollars over your Retirement / Lifetime.)

Our Wealth Report will compare all your investments with options for Tax-Free Retiement Income, and will tell you at what AGE YOUR MONEY WILL RUN OUT.

www.WesternStatesFinancial.com/John

and at your conveniently scheduled appointment that you choose, we will discuss your Retirement needs, obtain the needed information, and then provide you with a Wealth Report for FREE. (A $1,000 Value that can save you tens of thousands of dollars over your Retirement / Lifetime.)

Our Wealth Report will compare all your investments with options for Tax-Free Retiement Income, and will tell you at what AGE YOUR MONEY WILL RUN OUT.

We will NOT sell you anything.

NO OBLIGATION!

FREE items are to help educate you on TAX-FREE STRATEGIES.

If our options make sense to accomplish your goals for your Retirement and having TAX-FREE INCOME, a Tax-Free Death Benefit and TAX-FREE Transfer to your Heirs, then you will decide how you would like to proceed.......

No pressure sales.

WE PROMISE!

YOU WILL BE GLAD THAT YOU BOOKED YOUR APPOINTMENT!