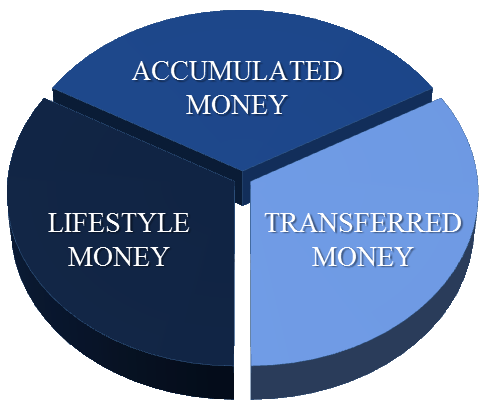

THREE TYPES OF MONEYThere are basically three types of money. The first - which gets the most focus - is your Accumulated money. This represents the amount of money you currently have invested and are currently saving. On a scale of one to ten, how would you say you are doing in accumulating the dollars necessary to meet your future retirement needs and goals? Any answer less than ten would mean that perhaps you should be putting more money away.

One reason that keeps people from saving is Lifestyle. Lifestyle money represents the dollars that you are spending to maintain your current standard of living; where you live, eat, vacation, etc. How much energy would you like to spend towards reducing your present standard of living so that you can save more? We know we need to save more and want to do so, but the only way we know to get the money is from our lifestyle. This brings us to the third type of money which is Transferred money and is a problem for some. Transferred money represents the money you may be transferring unknowingly and unnecessarily. Obviously, if you knew where the transfers were taking place you would have already solved those problems. As we sit down with you, we'll explore a few possible areas where you may be transferring money which can be recaptured.

Western States Financial feels it is important to begin focusing on money you may be transferring unnecessarily because this most often has the biggest impact your Circle of Wealth over time. The interesting thing is that by avoiding unnecessarily transfers, dollars are then freed up to put towards accumulation or lifestyle with no additional out of pocket cost. For more information about the three types of money, please contact us. |

QUICK CONTACTFINANCIAL VIDEOS |