However, nearly 7 out of 10 (68%) say they are spending less than they are earning and saving the difference, and 64% report having emergency savings to cover things like unexpected car repairs. More than three-quarters of respondents say they are paying off their consumer debt or living debt-free. Although these numbers are higher than or the same as they were in 2013, they are lower than they were in 2010.

Importantly, the percentage of Americans building their net worth through home equity has declined substantially over the past few years, from 68% in 2010 to 54% this year. And those who expect to live mortgage-free in retirement fell from 78% in 2010 to 68% today.

"Only about one-third of Americans are living within their means and think they are prepared for the long-term financial future," said Stephen Brobeck, executive director of the Consumer Federation of America and a founder of America Saves.

Sharp differences between income levels

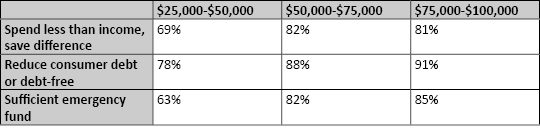

Perhaps not surprisingly, those reporting the greatest challenges were in the lowest annual income levels measured. While no stark differences were noted between the $50,000 and $75,000 income level and the $75,000 to $100,000 range, the percentages dropped dramatically in the $25,000 to $50,000 income range.

For example, although more than 8 out of 10 people in the higher income brackets said they had a sufficient emergency fund set aside, just 63% of those in the lower income level said they had enough to cover unexpected emergencies.

The survey authors note that one factor that may contribute to the decline is the falling percentage of Americans who say they have savings and spending plans. The percentage who report having a "savings plan with specific goals" fell from 55% in 2010 to 51% in 2014. Those with a spending plan that includes an amount set aside for saving fell from 46% in 2010 to 40% in 2014.

"As numerous studies have shown, those with a plan save much more effectively than those without one," said Dallas Salisbury, chief executive officer of the Employee Benefit Research Institute (EBRI) and chairman of ASEC.

"Individuals continue to become realistic about the need to save and plan themselves, rather than assumeit will be done for them," he continued. Each year in its annual Retirement Confidence Survey, EBRI finds that individuals who set financial goals tend to be more confident about their financial future than those who do not.

About the survey

The 7th annual national survey assessing household saving was released as part of America Saves Week, which took place February 24 to March 1, 2014. America Saves Week is an annual event that brings corporate, government, and nonprofit organizations together to promote good savings behavior. America Saves is managed by the Consumer Federation of America, and the American Savings Education Council is managed by EBRI. Sponsored by these organizations, the survey represented the views of 1,108 adult Americans contacted by phone from January 30 to February 2, 2014.

Get out of the 63%! Give us a call today at (951) 371-7608 or email us at [email protected] to review your savings strategy!

RSS Feed

RSS Feed