And if there’s any question about the clarity of that answer, try this on for size: Much, much more than you ever want to pay.

Consider this:

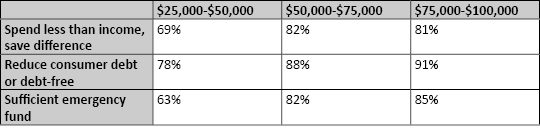

For most of us, the quality of life we experience in our later lives depends upon how well we manage “the margin” now.

What is “the margin”?

The margin is the amount of resources that we can pay forward during our most financially productive years. It’s about setting aside that “margin” of 4% or 6% or 10% or more during seasons when you’re able to earn and accumulate money. Then you manage that “margin” so that, independent of your sweat and work schedule, those dollars are able to multiply and grow into meaningful wealth.

In other words, accomplishing your dreams later in life comes down to making sure you have “left over dollars” NOW, that you invest those “left over dollars” wisely, and that you have time for them to mature and multiply into real wealth.

The real cost of poor credit is this: it robs you of that critical “margin.” It literally eats your quality of life.

How so?

Consider again:

With poor credit, you will likely pay more -- sometimes much more -- for your housing, car loans, car insurance, education loans, cell phone services and elective medical procedures. Furthermore, while prospective employers are barred by law from asking you about your age or sexual orientation or health, they can and will check your credit standing. And, as if all that’s not enough, the stress of credit

issues is often listed among top contributing factors in divorce proceedings. So let’s see...

RSS Feed

RSS Feed